Climate strategy

Climate governance

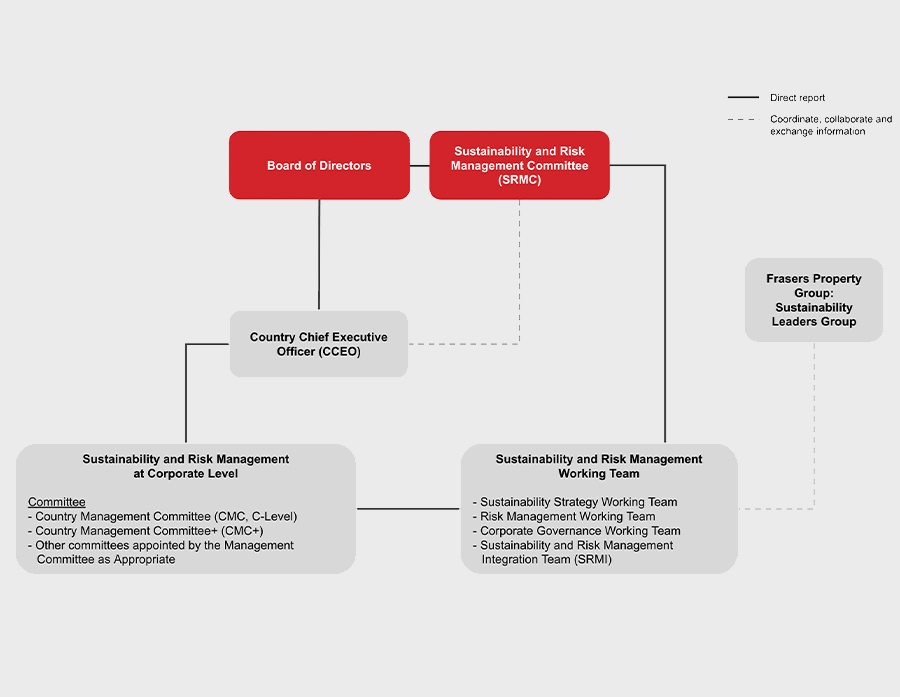

FPT’s climate governance structure supervise and manage our climate-related directions, such as setting policies, targets, and management approaches, etc.

The Board places great importance on addressing climate change as a crucial governance and strategic concern. It consistently features discussions related to strategy, portfolio evaluations, investment choices, oversight of risk management, and the assessment of performance against commitments, as well as communicate updates on sustainability progress and impacts to shareholders. The Corporate Governance & Sustainable Development Committee plays a pivotal role in supporting the Board's oversight of the Frasers Property Group's climate change performance and governance responsibilities. Meanwhile, the Risk Management Committee assist the Board in supervising climate-related risk management.

In 2024, Frasers Property Thailand has a plan to integrate the Corporate Governance Sustainable Development Committee (CGSDC) and the Risk Management Committee (RMC) as a Sustainable Risk Management Committee (SRMC). This committee is expected to oversee and govern all functions and working team regarding corporate governance, enterprise risk management, and sustainable development by considering potential and actual risks, sustainability performance, and risk management that may affect the business operation.

Risks and opportunities

FPT has comprehensively assessed and identified climate-related risks and opportunities throughout our own operations across different time horizons by 2030 (short term), 2040 (medium term), and 2050 (long term). To comprehensively understand potential impacts of climate change on the business’s contexts, we conducted scenario analyses and identify climate-related physical risks and transition risks by considering the data availability and business context.

Physical risks

The existing situation regarding physical risks resulting from climate change can be both event-driven (acute) risks, and long-term shifts (chronic) risks in climate patterns. Nine physical risks were identified as a baseline out of which seven physical risks were analysed in scenario analysis to evaluate the risk exposure in short term (2030), medium term (2040), and long term (2050).

|

||||

| Lighting | Cyclone | Urban Flood | Riverine Flood | Coastal Flood |

Extreme Heat

|

Drought | Water Stress | Water Depletion |

Transition risks

Transition risks are the challenges and uncertainties that our businesses face as they navigate the ongoing global shift towards a more sustainable and low-carbon economy. By considering the different influencing factors, e.g., national & international policy, IEA data prediction, and real estate sustainability trends, nine transition risks were evaluated through scenario analysis and classified into four categories which are policy and regulation, market, technology, as well as reputation risks.

| Policy and Regulation | Market | Technology | Reputation |

|

|

|

|

Task Force on Climate-Related Financial Disclosures

FPT has applied the Task Force on Climate-related Financial Disclosures (TCFD) framework to manage climate-related risks and opportunities. Additionally, FPT has started to publish annual disclosures to be aligned with the TCFD Framework in 2023.